The procedure for filling out the form mp micro. Form MP (micro) - a sample of filling for delivery to Rosstat. II. Calculation of the volume of commercial transportation of goods and commercial cargo turnover, performed by trucks, for which transport is not recorded

At the beginning of this year, statistics agencies sent letters to many small businesses asking them to submit the stat. observation of MP-SP. It consists in filling out information on important indicators activities of firms over the past year. The form is compiled in accordance with federal law on a mandatory basis if the company is a small business entity.

The norms of the act determine that the requirement for the submission of forms applies to small enterprises, including farms and peasant farms... The assignment of firms to this category is made on the basis of the indicators specified in the Federal Law No. 209 of 24.07.2007. This is mainly the number, the amount of revenue, etc.

If the company has divisions, then it must send general information at its legal address. In cases where the enterprise partially temporarily did not work during the year, it also needs to submit the form of the MP JV to general order.

Terms of provision and penalties

Statistics form MP SP is a one-time reporting. She surrenders to either hard copy, either in in electronic format before April 1 of the year following the reporting year at the place of registration of the company, regardless of the actual address.

In cases where the company does not draw up and does not send on time the form of statistical observation of the mn joint venture, or when filling it out, incorrect data will be indicated, administrative measures may be applied to it, in particular the provisions of Art. 13.19 of the Administrative Code of the Russian Federation.

According to these norms, fines are provided for the company from 20,000 rubles. up to 70,000 rubles, for her responsible persons from 10,000 rubles. up to 20,000 rubles. If this violation is committed again, the organization can be fined from 100,000 to 150,000 rubles, officials- from 30,000 to 50,000 rubles.

Sample filling out the form MP SP

For the preparation of these statistical reports, the instruction for filling out the form mp sp is used as a guide.

The report must indicate the name of the company, its address at the place of registration, including the postal code, registration numbers, TIN.

V line 01 the start date of work is recorded in the form of a month and a year. Next, a mark is made whether the activity was carried out, and in case of a positive answer - for how many months. If the actual and legal address and do not coincide, then in line 5 you need to enter the place of implementation of the activity.

Clause 1.5 fill only joint stock companies, in it they should reflect whether the change of founders took place or not in reporting period.

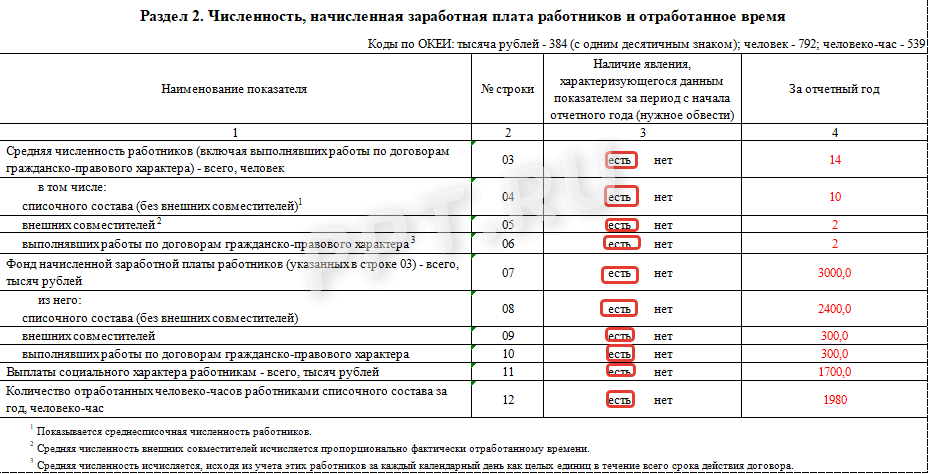

V section 2.1 you need to fill in the data on the main indicators in relation to workers. Here you need to indicate the number on average per year for all employees and with a breakdown by payroll. Funds of the accrued wages for all employees and for payroll.

V line 16 information is recorded on the average population size for the previous year.

V section 2.2 it is necessary to record information on the costs of production and sales in the context of cost goods sold, the cost of used in the reporting period, rental fees for equipment, premises, and other services and works.

If the processing of raw materials and materials was carried out, then you need to fill out line 18.

V section 2.4 it is noted whether the company provided services to the population, and it is necessary to decipher whether it is a manufacturer, an intermediary, etc.

In the next line, it is necessary to reflect whether there were export operations in the reporting period.

V section 2.6 information is filled in on the proceeds from sales in general for the reporting period in comparison with the previous one, with a breakdown by type of activity. If construction services were provided, then the proceeds are recorded in line 30.

V Section 2.8 it is necessary to fill in the proceeds from construction work if, upon receipt, the services of third-party enterprises were used with decoding for services of a construction and scientific and technical nature.

Further, the data on the implementation of technological, organizational and marketing innovations are noted.

V section 3.1 information on the availability of fixed assets and intangible assets is filled in. In the relevant sections, you need to reflect the fund balances at the beginning and end of the year at the initial and residual value. Information about the receipt of property during the year is also entered here. The last column of the section records information on the availability of intangible assets at the beginning and end of the year, as well as their receipt.

V Section 3.2 an appropriate entry must be made on the availability of freight transport.

Then the information about state support is filled in. Here you need to write down whether there was help within the framework of special programs and decipher which one. In the case when governmental support does not appear, it is necessary to indicate whether the company is informed about this or not.

The report is signed by the responsible official, with a breakdown of the position, full name .. The date of signing, contact phone number, and e-mail are also indicated here.

An example of filling out the form of an MP JV can be seen below, only a part of it is shown in the picture in the article.

Nuances

If the company has a freight vehicle, but rents it or leases it, then it needs to fill in line 40.

The TZV-MP form and the procedure for filling it out were approved by Order of Rosstat dated July 29, 2016 No. 373 (See ""). The new form will need to be submitted at the end of 2016 to the Rosstat authorities. What is the deadline for the report? Will it be necessary to submit a new report to all organizations and individual entrepreneurs without exception? How do I fill out a new report? Is there liability for non-submission of TZV-MP? In this article, we will look at the most important issues related to filling out and submitting new reports.

Introductory information

The new form No. ТЗВ-MP is called "Information on the costs of production and sale of products (goods, works and services) and the results of a small enterprise in 2016". It is already clear from the title of the report that it will be necessary to report using the new form at the end of 2016.

Deadline for delivery of TZV-MP

The report must be submitted by April 1, 2017 to the territorial office of Rosstat at the location of the organization. This period is indicated on the title page of the TZV-MP form. However, April 1, 2017 falls on Saturday. In this regard, the report can be submitted on the next working day. That is, April 3, 2017, Monday.

Moreover, if the organization does not carry out activities at the place of its location, then the TZV-MP can be handed over at the place of actual implementation of activities (section 1<Указаний по заполнению ТЗВ-МП>, approved By order of Rosstat dated July 29, 2016 No. 373).

But who exactly is obliged to submit the TZV-MP form to the Rosstat authorities? Before answering this question, we consider it appropriate to clarify what types of statistical observation, in principle, exist.

Selective and complete statistical observation

Federal statistical observation is selective and continuous (Art. 6 Federal law dated November 29, 2007 No. 282-FZ).

Continuous observation

Within the framework of continuous observation, statistical reporting must be submitted by all (without exception) respondents of the studied group. Continuous statistical observation of small and medium-sized businesses is organized once every five years (part 2 of article 5 of Law No. 209-FZ). The last time a complete observation was already carried out in 2016. Until April 1, 2016, within the framework of continuous observation, all small (including micro) enterprises - legal entities and all individual entrepreneurs had to submit reports to Rosstat divisions in the forms approved by Rosstat order No. 263 dated 09.06.15:

- for small organizations - form No. MP-sp "Information on the main performance indicators of a small enterprise for 2015";

- for individual entrepreneurs - form No. 1-entrepreneur "Information on the activity individual entrepreneur for 2015 ".

Thus, in 2016, a continuous observation in 2016 has already been carried out. Accordingly, it will not be held in 2017. And the form of TZV-MP has nothing to do with continuous observation.

Selective observation

Selective observation is carried out to collect statistical data for some groups of respondents, which are determined on the basis of a sample of Rosstat. Within the framework of selective observation, statistical reports must be submitted by specific organizations or individual entrepreneurs who were included in the sample. At the same time, Rosstat bodies are obliged to notify those who were in the sample about the forms and methods of submitting reports.

The TZV-MP form will be used precisely within the framework of selective statistical observation. Accordingly, this form will only need to be submitted in a situation where a particular organization is included in the Rosstat sample. All companies, without exception, do not need to hand over the TZV-MP form.

Who can be included in the Rosstat sample

V<Указаниях по заполнению ТЗВ-МП>approved by Order of Rosstat dated July 29, 2016 No. 373, it is said that only organizations (including peasant farms) that are small enterprises should submit this report. Thus, individual entrepreneurs (IE), medium and micro-enterprises should not be included in the Rosstat sample in any way and they will not need to submit the TZV-MP form in 2017.

| Criterion | Index |

| Limit value of the average number of employees for the previous calendar year. | - 15 people - micro-enterprise; - 16-100 people - small business; - 101–250 people - a medium-sized enterprise. |

| Income for the year according to the rules of tax accounting. | - 120 million rubles. - micro-enterprise; - 800 million rubles. - small business; - 2000 million rubles. - a medium-sized enterprise. |

| The total share of participation in the authorized capital of LLC RF, constituent entities of the RF, municipalities, public, religious organizations, foundations. | 25% |

| The total share of participation in the authorized capital of the LLC of other organizations that are not small and medium-sized businesses, as well as foreign organizations. | 49% |

Whether the organization was included in the sample: how to find out

As we have already said, information on the inclusion of an organization in the list of selective statistical observation must be reported by Rosstat divisions (clause 4 of the Regulations, approved by the RF Government Decree of 18.08.2008 No. 620). However, the procedure for communicating such information to organizations is clearly regulated.

Therefore, in practice, Rosstat bodies solve this issue in different ways:

- some publish on their websites lists of organizations included in the sample;

- some inform organizations about inclusion in the sample by sending letters to the addresses indicated in the Unified State Register of Legal Entities.

But it also happens that Rosstat divisions do not notify organizations at all that they are included in the sample. Therefore, it is possible that an organization may be included in the sample, but not receive any notification from Rosstat. Therefore, if, for some reason, the organization does not know whether they are included in the list of selective statistical observation, then it makes sense to contact your Rosstat division and find out whether the company was included in the sample and whether it needs to pass the TZV-MP before April 1, 2017.

Filling TZV-MP: sample

The TZV-MP form for 2016 must include information for the organization as a whole: for all branches and structural units regardless of their location.

The composition of the TZV-MP form is as follows:

- title page;

- section 1 "Information on the proceeds from the sale of products (goods, works, services) and their production";

- section 2 "Expenses for the production and sale of products (goods, works and services)".

Here is a sample and an example of filling the TZV-MP.

Title page

On the title page of the form, you must indicate the full name of the organization according to the constituent documents, and in brackets - a short one.

On the line "Postal address" the legal address with postal code... You also need to note the actual address if it does not coincide with the legal one. In the code part of the title page, write down the OKPO assigned by Rosstat. Here is a sample of how to fill out a title page.

Section 1

The first section is information about the organization's revenue. In it, you need to decipher the income of the organization in 2016. There are 7 lines in total in the section. Let us explain what needs to be reflected in them.

| Section line 1 TZV-MP | Filling |

| 01 | The total amount of revenue for the year. It should equal the revenue from the income statement. |

| 02 | Proceeds from the sale of products, services own production. |

| 03 | Organization - the general contractor must show the cost of the work performed by the subcontractor construction works without VAT. At the same time, there is no need to reflect the cost of installation and commissioning of technological equipment. |

| 04 | The organization - the general contractor must show the cost of the work performed by the subcontractor and accepted works scientific and technical (excluding VAT). |

| 05 | Proceeds from the sale of goods purchased for resale, as well as raw materials, materials, components, fuel purchased for production, but sold outside without processing or processing. |

| 06 and 07 | Filled in by agricultural organizations. |

Section 2

In section 2, decipher the 2016 expenses. In total, section 2 lines from 08 to 54. Let us explain the features of filling in some of them.

| Section line 2 TZV-MP | Filling |

| 08 | Purchase value of goods, excluding VAT, purchased in 2016 for resale. Moreover, regardless of whether they were sold in the reporting year or remained in stock. The line reflects the goods recorded on the debit of account 41. |

| 09 and 010 | Remains of goods purchased for resale at the actual cost of their acquisition, excluding VAT. Data at the beginning and at the end of 2016. |

| 11 | The cost of material assets acquired in 2016, regardless of how much of them was used or remained in the warehouse in the reporting year. In this line, reflect the acquired production material values, which were accounted for at the acquisition cost on the debit of accounts 10, 11, 15, 16. |

| 12 | The cost of all types of fuel purchased in 2016. Reflect expenses in this line at purchase prices excluding VAT. |

| 14 and 15 | The cost of inventory balances - raw materials, materials, fuel, purchased semi-finished products, components, packaging - intended for use in production or for sale at the beginning and end of the reporting year. |

| 16 | Purchase cost of raw materials, materials, semi-finished products, components, fuel purchased for production, but sold in 2016 without processing. |

The IOT-MP report must be signed by the official responsible for providing statistical information on behalf of the organization. That is, the director can write the report. Or, say, an accountant, if he has the appropriate authority.

Note that the sample may include an organization that did not conduct financial and economic activities in 2016. At the very least, we will not rule out the situation that the sample will include a company that had no account movement at all in 2016. Is it then necessary to take the TZV-MP and how to fill it out? Yes, if an inactive organization is included in the sample, then the report must be submitted. But then, in the form No. ТЗВ MP, simply fill in the title page, and in sections 1 and 2 put dashes.

Method of delivery of TZV-MP

The TZV-MP form can be submitted (clause 10 of the Regulation approved by the decree of the Government of the Russian Federation of August 18, 2008 No. 620):

- “On paper” (in person, through a representative or by sending a report by mail);

- electronically through a special operator providing services electronic document management(using enhanced qualified electronic signature);

- in electronic form through the web collection system, if it is organized on the website of the territorial division of Rosstat (for example, such a system is implemented on the Mosoblstat website). To use this method of submitting reports, you will need to submit an application and receive a login and password to access the service. In this case, a qualified electronic signature key certificate is required.

A responsibility

If you do not pass the TZV-MP on time or provide inaccurate and incomplete data, you will have to pay a fine. Its size is specified in article 13.19 of the Code of Administrative Offenses of the Russian Federation:

- the organization will pay the amount of 20,000 rubles. up to 70,000 rubles, and for a repeated violation from 100,000 rubles. up to 150,000 rubles;

- the director will pay from 10,000 rubles. up to 20,000 rubles, and for a repeated violation from 30,000 rubles. up to 50,000 rubles.

Cases related to these violations are considered by the territorial bodies of Rosstat (Article 23.53 of the Administrative Code of the Russian Federation). To impose a fine, the controllers have two months from the date of the violation, that is, from the date of the expiration of the reporting period (Article 4.5 of the Administrative Code of the Russian Federation). This means that if the TZV-MP report must be submitted no later than April 3, 2017, then Rosstat employees will be able to fine for failure to submit it no later than June 3, 2017.

Statistical reporting of micro-enterprises is the minimized obligation of organizations with micro-enterprise status to report to statistical authorities. One of such reports submitted at the end of the year is called "Form MP-micro": this article will tell you who should submit this report and in what time frame.

Statistical reporting applies to absolutely all organizations, regardless of their size. Some reports need to be submitted regularly, in particular, accounting results for the year, and some - after a certain period and only to those respondents who were included in the Rosstat sample. Such a report is the MP-micro form, approved by the Order of Rosstat dated 02.11.2018 No. 654. The report is called "Information on the main indicators of the micro-enterprise activity" and is annual. Let's consider its features in more detail.

Form MP-micro: who is obliged to take

This report is intended exclusively for legal entities that are categorized as micro-enterprises. These are the organizations that in 2018:

- no more than 15 employees worked;

- annual income from maintenance entrepreneurial activity amounted to no more than 120 million rubles;

- share of participation state entities, public and religious organizations and foundations did not exceed 25% in total;

- the share of participation of other companies (including foreign ones) did not exceed 49% in total.

Exceeding the limit values for 3 consecutive calendar years leads to the loss of status.

If a firm fits these parameters, it is necessary to check whether it was included in the sample of statistical observation. This can be done using a special service on the Rosstat website. It is enough for an organization to enter all its data (name, OKPO, TIN or OGRN) into the proposed form and receive information about all reports in statistics that must be submitted in 2019. In addition, Rosstat authorities notify the respondents in the sample in advance about the need to report. Rosstat sends such written notifications to known company addresses.

MP-micro: due date 2019

In 2019, the date for the submission of the MP-micro report for 2018 falls on February 5. No transfers are provided as it is Tuesday. It is this date that appears in the Rosstat Order as the last day for the fulfillment of the obligation to report. Being late can result in a serious fine.

Features and order of filling

It is not at all difficult to fill in the MP-micro, it is drawn up in the form of a questionnaire. In the header, as usual, you must write the details and name of the organization, as well as its postal address.

Further in the MP-micro section 1 goes, in which only one question needs to be answered: does the company apply a simplified taxation system. There are obviously two possible answers: "yes" and "no". Opposite the correct option, you need to put a mark.

The second section in the MP-micro form is more voluminous. It is intended for information about the number and wages of employees. To fill it out, you need to calculate average headcount and also indicate the number external part-timers and persons who work under civil contracts. By the same principle, it is necessary to divide the wage fund. At the end, you need to provide information on social benefits to employees, as well as indicate the number of man-hours worked.

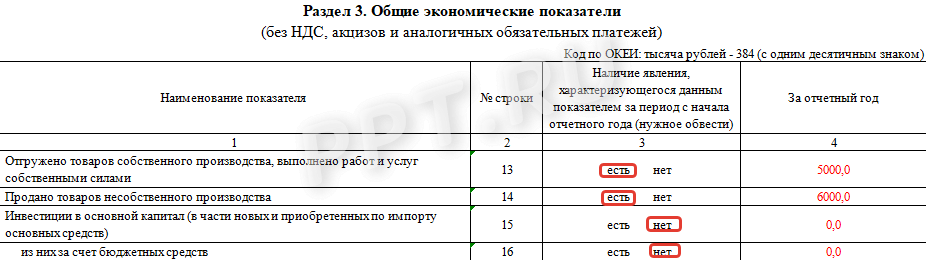

The third section is small and is called "General economic indicators". You need to fill in information about the shipment of goods, performance of work and services. Also, in the same section, you need to inform the statistics body about investments in fixed assets. All data must be provided in rubles, and VAT and excise taxes must be deducted from the cost.

The fourth section of the MP-micro form is intended for firms that are engaged in wholesale and retail trade or are enterprises Catering... It should be noted in it whether or not there are such turnovers, and also indicate their volume for the reporting period.

The final, fifth section of the MP-micro report should be filled out by organizations if they have drivers on their staff and they use any freight or light transport for their needs. Even one car obliges the accountant to complete this section.

At the end, the report must be signed by the accountant who filled it out. You also need to put down the date of filling and indicate email and phone number.

What reports are submitted to statistics of micro-enterprises in 2019

In addition to information about the activities of MP-micro organizations, the smallest companies and individual entrepreneurs are required to send other forms to Rosstat:

- balance sheet and form No. 2 (possible in a simplified version) - until 03/31/2019;

- form No. MP (micro) -nature "Information on the production of products by a micro-enterprise" for firms that manufacture products, mining, processing industries, companies that produce and distribute electricity, gas and water, logging, as well as those involved in fishing - until 25.01 .2019 (Order of Rosstat dated July 27, 2018 No. 461);

- annual form No. 1-IP "Information on the activities of an individual entrepreneur" exclusively for individual entrepreneurs - until 03/02/2019.

In addition, other statistical documents may be added depending on the industry in which the firm operates and its field of activity.

Liability for failure

For violation of the deadlines or ignorance of the obligation to submit statistical reports, there are large fines. They are provided article 13.19 of the Code of Administrative Offenses of the Russian Federation, and their size is:

- for officials - from 10,000 to 20,000 rubles;

- for organizations - from 20,000 to 70,000 rubles.

A repeated violation will cost significantly more, the fine rises to 50,000 rubles for officials, and up to 150,000 rubles for legal entities. The statistics body can be held accountable within two months from the date of the violation.

To classify an organization as a micro-enterprise, its performance indicators must meet certain criteria (Article 4 209-FZ of July 24, 2007):

- the number should be no more than 15 employees;

- income from doing business should not exceed 120 million rubles.

What reports are submitted to statistics of micro-enterprises in 2019

The activities of small businesses (including microenterprises) are subject to continuous statistical monitoring every five years. The last such observation was in 2016 based on the results of activities for 2015.

In the intervening periods, micro-businesses are subject to only selective observation once a year. Its rules are established by the Government Decree of 16.02.2008 No. 79.

A complete list of statistical reporting for microorganizations is 18 forms. The overwhelming majority of them are associated with specific activities. Basic form: MP (micro); who is obliged to submit a report, we will figure it out below.

To understand whether an organization is included in the sample or not, one should refer to the special resource of Rosstat statreg.gks.ru. On the page that opens, filling in the company data, you can get a list of statistical forms to be submitted. Some regional offices of Rosstat publish a list of organizations included in the sample on their websites. For example, a list of selected organizations in St. Petersburg and the Leningrad Region can be found on the Petrostat page in the Reporting → Statistical reporting → List of reporting business entities.

MP (micro) due date 2019

The statistic we are considering was approved by order of the Federal State Statistics Service of August 21, 2017 No. 541. It also contains a brief explanation of how to fill it out.

Form MP (micro)

The MT (micro) report submission date is set for February 5th. If you are late with the submission of the form, then it is possible to apply penalties. According to article 13.19 of the Code of Administrative Offenses of the Russian Federation, a fine for a company for failure to submit statistical reporting can range from 20,000 to 70,000 rubles.

There are situations when statistics authorities request reports despite the fact that when requesting the resource statreg.gks.ru it is not reflected in the list. In order to avoid penalties, we recommend saving a screenshot of the page. If the report was not named in the list to be submitted on the resource and the company was not notified in writing by Rosstat about the need to submit the report, penalties are not applied.

Also, statistical bodies can request filling out the form MP (micro) - nature. It contains information about the products manufactured, is filled in quantitative terms and is subject to delivery by January 25 of the year following the reporting year.

Blank MP (micro) - nature

Sample report filling

The detailed Instructions of Rosstat on filling out the MP (micro) form were approved by Order No. 723 of November 7, 2017.

The report is filled in according to the basic data of the micro-enterprise's work and consists of a title page and five sections. Information about the organization is filled in on the title page. The sections of the report provide information on:

- taxation system;

- the number and wages fund;

- the amount of revenue;

- the amount of investment in fixed assets;

- about cargo transportation.

The form is provided by all organizations caught in selective observation, including those that did not conduct business or were declared bankrupt, if there is no decision of the arbitration court on liquidation in respect of them.

Non-operating micro-enterprises submit reports with zero values of cost indicators.

Form MP (micro) for 2018: form, sample free download

Who is obliged to pass the MP (micro) form for 2018

Only micro-enterprises that were included in the statistical sample are required to submit the MP (micro) form for 2018. Micro-enterprises include companies that meet the following conditions (Article 4 of the Federal Law of July 24, 2007 No. 209-FZ):

- the average number of employees for the previous calendar year does not exceed 15 people;

- business income does not exceed 120 million rubles.

Individual entrepreneurs do not hand over the MP (micro) form. The experts of the Glavbukh system spoke in more detail about what statistical reports to submit in 2018.

You can find out if a micro-enterprise was included in the sample using the service websbor.gks.ru/online/#!/gs/statistic-codes. To do this, you must enter the TIN, OKPO or OGRN. The service will display a file with a list statistical forms... In the file opposite each form there is information about the deadlines. If the company is not monitored, the site will return an empty file.

The deadline for the submission of the MP (micro) form for 2018 in 2019

The MP (micro) form must be submitted no later than February 5 of the following year. This is indicated in the form itself. So micro-enterprises must report for 2018 no later than February 5, 2019.

If a micro-enterprise was included in the sample, but did not submit a report, it will be fined under Article 13.19 of the Code of Administrative Offenses of the Russian Federation. For officials, the amount of sanctions is from 10,000 to 20,000 rubles. For organizations - from 20,000 to 70,000 rubles. The exact amount will be appointed by the head or deputy of the territorial body of Rosstat (part 2 of article 23.53 of the Administrative Code of the Russian Federation).

Form MP (micro) for 2018

New form annual report MP (micro) "Information on the main performance indicators of a micro-enterprise" approved by order of Rosstat dated July 27, 2018 No. 461.

Where to submit the MP (micro) form at the end of 2018

It is necessary to submit a report to the territorial branch of Rosstat at the location of the organization. If the micro-enterprise does not operate at its location, the report should be submitted to the branch at the place of business.

Moreover, it is necessary to submit the MP (micro) form even if the company has been operating for only a few months in the reporting period. In this case, the report should indicate the period during which they did not work.

How to fill out an MP (micro) form

Filling out the MP (micro) form for 2018 follows the rules set forth in Rosstat order No. 654 dated 02.11.2018. The MP (micro) form consists of a title page and five sections. How to fill out the report correctly was clearly shown by the experts of the Glavbukh system.

Title page

On the title page of a micro-enterprise, the full name of the company is entered in accordance with the constituent documents.

In the line "Postal address" indicate the name of the subject of the Russian Federation and the legal address with a postal code. If the actual address does not match the legal address, the actual mailing address is also reflected.

In the code part of the MP (micro) form for 2018, enter the OKPO code (column 2) and the OKVED code 2 (column 3).

Section 1

Section 1 is called "Questionnaire". There is only one question “Are you applying the simplified taxation system?” To which you need to choose the answer “Yes” or “No”.

Section 2

Section 2 "Number, accrued wages and hours worked" is a table. By line 03 record the average number of workers in the microenterprise. That is, this line indicates the average number of employees, the average number of external part-time workers and the average number of employees who performed work under civil contracts. The experts of the Glavbukh system spoke in more detail about how to calculate the average number of employees.

V line 04 enter the average number of employees payroll without external part-timers, in line 05- the average number of external part-time workers, in line 06- the average number of employees who work under GPC contracts.

By line 07 write down the payroll of employees from line 03. The payroll includes:

- remuneration of labor in cash and non-cash form for hours worked and not worked;

- compensation payments related to working conditions and working hours;

- surcharges and allowances;

- bonuses and one-time incentive payments;

- payment for food and accommodation, if it is systematic, etc.

In the form No. MP (micro), they show the sums of money accrued for 2018, taking into account personal income tax and other deductions. The sources of payments and the timing of the actual payment do not matter.

By line 08 enter the payroll of payroll employees without external part-time workers, according to line 09- external part-timers, by line 10- employees who work under GPC contracts.

V line 11 enter information about social benefits to employees. For example, payments of a social nature need to include the costs of the company for providing employees with social benefits, in particular, for treatment, rest, travel.

By line 12 indicate the number of man-hours worked by payroll employees per year. This takes into account the hours worked both in the main job and within the framework of internal part-time jobs.

Section 3

Section 3 records the overall economic performance of the micro-enterprise. Information is entered without VAT, excise taxes and similar mandatory payments.

Section 3 of the MP (micro) form for 2018 among financial and credit organizations should be completed not only by pawnshops, but also by banks, insurance organizations, stock exchanges, etc. They only fill in lines 15 and 16

By line 13 record the volume of goods shipped or released in the order of sale, as well as direct exchange, commodity credit of goods of their own production, work performed and services rendered on their own. The experts of the Glavbukh system told in more detail.

By line 14 reflect the value of goods sold externally purchased for resale.

By line 15 organizations - customers for implementation investment projects vested with such a right by the investor, reflect the investment in fixed assets.

By line 16 from line 15, investments in fixed assets are allocated at the expense of budgets of all levels

Section 4

Section 4 reflects information on wholesale and retail trade and catering turnover.

By line 17 record the proceeds from the sale of goods at retail, including VAT, excise taxes and similar payments.

By line 18 reflect turnover retail food, including drinks, and tobacco products, on line 19- turnover of alcoholic beverages and beer.

V line 20 record the proceeds from the sale of goods in bulk, including VAT, excise taxes and similar payments, in line 21- from the provision of catering services.

Section 5

Fill in section 5 of the form No. MP (micro) for 2018 for the carriage of goods by road must be micro-enterprises whose activities are related to transportation.

By line 28 record quantity data trucks that the micro-enterprise uses for transportation.

V line 29 indicate the volume of goods transported (in tons) on commercial basis by the actual weight of the cargo, taking into account the tare weight, the weight of the container for each trip.

V line 30 put down the volume of cargo turnover performed on a commercial basis - the number of performed ton-kilometers.

An example of calculating key figures for lines 29 and 30.

During the day, three trips were performed: the first trip - 3 tons at a distance of 20 km, the second ride - 4 tons at a distance of 30 km, the third ride - 3 tons at a distance of 10 km. In this case, 10 tons (3 tons + 4 tons + 3 tons) are written in line 29, on line 30 - 210 ton-kilometers [(3 tons x 20 km) + (4 tons x 30 km) + (3 tons x 10 km)].

It might be helpful to read:

- Craft from plasticine for the day of cosmonautics;

- School riddles - fun activity for kids;

- How to mold a plasticine bat step by step with a photo;

- Embroidered keyrings Embroidered keychain diagram;

- Station game "fair";

- Games in the summer day camp for primary school children;

- Camp competitions for children;

- Children's riddles about transport;